Financial Modeling using Advance Excel

In today’s dynamic world of quick data analytics business decisions are increasingly dependent on number crunching. Any business idea or project has to be backed with detailed and accurate information & analysis presented in a easy to understand and scalable format that can withstand the scrutiny of Managers and stakeholders. In financial domain, it becomes imperative that project proposals or business analysis has been done with correct modeling techniques which enables accurate forecasts, ‘what if’ Scenarios and design realistic forecasts.

It has been established that the ability to accurately and efficiently model the business problems, performance and solutions on a comprehensive financial model will determine the organization’s growth rate and success.

Financial modeling with Advance Excel is relevant and highly successful practical course which will change the way you worked with Excel, models and analytics and take you a higher level of data analysis, modeling solutions, forecasting Financial Statements.

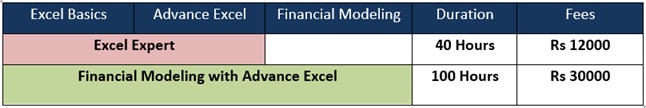

This course is divided in 3 parts :

Who should do?

Financial modeling is a Skill set needed in Finance industry as well as in day to day business activities like accounting, market research, projecting outcomes, MIS reporting etc. This program is highly recommended to professionals working in finance & risk domains, managers working in a collaborative environment, Chartered Accountants , candidates pursuing career professional courses like ACTUARY / CFA / FRM / CA / ICWA / MBA / ACCA . It is also useful for entrepreneurs and candidates involved in family businesses for business planning and day to day activities.

Job Profiles requiring Financial modeling Skill.

- Accounting and Taxation Profiles

- Business Process Outsourcing Profiles

- Merchant Banking profiles like Mergers & Acquisitions, Equity research & financial engineering.

- Research Agencies using statistical analysis like Credit Rating agencies etc.

- Data Analytics profiles

- Project Finance and corporate Finance profiles

- Online Free lancing work available on free lancing websites.

- Finance profiles in banks & corporates.

- Business Analyst profiles in IT companies like TCS, Infosys etc.

Course Requirements (Hardware and Software)

- Laptop / Notebook with Microsoft Windows 10 Installed.

- Microsoft Excel 2013 or Microsoft Excel 2016 & above (recommended) installed.

- Internet and screen sharing software will be provided by the institute.

Course Curriculum

- Mastering the tool : Excel Basics and Advance Excel

- Generate Solutions : Financial Modeling

Course Duration and Fees

Course Faculty: Gaurav Gangwal, CFA, FRM, B.Tech (IT), MBA

REGISTER HERE

Frequently asked questions (FAQ)

What is financial Modelling course?

What exactly is financial modeling?

Financial modeling is the process of creating a summary of a company’s expenses and earnings in the form of a spreadsheet that can be used to calculate the impact of a future event or decision. A financial model has many uses for company executives.

What are the different types of financial models?

- Three Statement Model

- Discounted Cash Flow (DCF) Model

- Merger Model (M&A)

- Initial Public Offering (IPO) Model

- Leveraged Buyout (LBO) Model

- Sum of the Parts Model

- Consolidation Model

- Budget Model

- Forecasting Model

- Option Pricing Model

What is financial Modelling generally used for?

Accounting. In corporate finance and the accounting profession, financial modeling typically entails financial statement forecasting; usually the preparation of detailed company-specific models used for decision making purposes and financial analysis.

Is financial Modelling a good career?

Yes, Financial Modeling is widely used in investment banking, corporate banking, risk departments, etc. … Financial Modelling has immense scope but please note that it is an important skill required for making a career in Finance. Financial Modelling is not a career in itself.

What are financial modeling skills?

Financial modeling is one of the most highly valued but thinly understood skills infinance. The objective is to combine accounting, finance, and business metrics to create an abstract representation of a company in Excel, forecasted into the future.

What is the difference between Financial Analysis and Financial Modelling ?

Financial Analysis is typically carried out using ratio and trend analysis of relevant information taken from financial statements and other reports .”” Financial modelling on the other hand, is essentially the task of building a model that represents a real world financial situation .

Where is Financial Modelling used ?

Financial Modelling is a representation in numbers of a company’s operations in the past , present and the forecasted future . Such models are intended to be used as decision making tools . Company executives might use them to estimate the coast and projects the profits of a proposed new projects .

Is Financial Modeling is in demand ?

Financial Modelling skills has high demand in current scenarios where business id depends upon data science to make Financial Models and forecast future trends , It has a lot of scopes in various finance related segment and is very distinct from the traditional accounting and audit jobs .

What is the future in Financial Modeling ?

In the future , Financial Models are likely to have artificial intelligence . This means that the computer will be able to understand the success or the failure of their own model . This will be done when the system compares the actual results to the ones projected by the model .

Do Accountants do Financial Modelling ?

I estimate that a large majority of an accountants are capable of learning financial modelling is given time to focus on it . It will certainly be worth it given the current employment odds , but it does stat with a change in your mindset .

How long does it take to learn Financial modeling ?

It practically takes 20-1 month to complete a program and its learning is depend upon you . Financial Modelling training is necessary to comprehend the motorists and the effects of organizations choices .

How do i get a job in Financial Modelling ?

After learning financial modelling , Taking up certification of Financial Modelling is the best way out . To find a job in best Financial organizations .

Is Financial Modeling is hard ?

Financial Modeling is hard if you are trying to figure out on your own , but with the help of a professional training programs like EduAscent Institute Of Finance , the modelling process becomes a lot easier .